You can find your Chime routing and account information in the Move Money section or under the Settings section in your iPhone or Android app.

Banking Services provided by The Bancorp Bank, Member FDIC. The Chime Visa® Debit Card is issued by The Bancorp Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

Simply provide your Chime routing and account number to your employer or payroll provider to receive direct deposit to your Chime Spending Account. Your routing number can be found in the Move Money and Settings sections of the Chime app or at chimebank.com. You can also have a direct deposit enrollment form emailed to you from the Move Money section of the Chime app.

Early direct deposit may provide you with access to your paycheck up to two days early. Faster access to funds is based on a comparison of traditional banking policies and deposit of paper checks from employers and government agencies versus deposits made electronically.

You can link an external account you own to your Chime Spending Account by logging into the Chime app or online at chimebank.com. From the app, go to Settings, tap “Link a Bank Account”, choose from one of the banks listed and enter your other bank’s login credentials.

To link an external bank account online, log in to chimecard.com, select Move Money, click the Transfers button and select Transfer Funds. Click the drop-down arrow in the FROM field, then click LINK ANOTHER BANK ACCOUNT and select from one of the banks listed (see below for a list of supported banks).

You will then be prompted to enter your other bank’s login credentials. Once the external account is linked, you can make transfers from the external account to your Spending Account of up to $200.00 per day and $1,000.00 per month. Transferred funds will be available within 5 business days.

We support the following banks: Chase, Bank of America, Wells Fargo, Citi, US Bank, USAA, Fidelity, PNC Bank, Capital One 360, TD Bank, SunTrust, Navy Federal & Charles Schwab. We hope to add others in the near future!

Bank Transfer Initiated from an External Account: Many banks will allow you to make transfers from their website. If you have an external bank that offers this service, just log in to their website and add your Chime Spending Account using the routing and account numbers you would use for direct deposit.

Mobile Check Deposit

Chime offers Mobile Check Deposit for any members who are enrolled in direct deposit with their Chime Spending Account. If you have any questions, please reach out to us via the Support tab in your Chime app, and we’ll be happy to help.

How do I deposit money into my account?

Banking Services provided by The Bancorp Bank, Member FDIC. The Chime Visa® Debit Card is issued by The Bancorp Bank pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

The easiest way to deposit funds to your Spending Account is by direct deposit from your employer.

To make direct deposits through your employer or payroll provider, provide them with your Chime routing number and Spending Account number. Chime takes care of the rest.

Your funds will automatically post to your Chime Spending Account as soon as we receive them. To get started, you can find your bank routing number and Spending Account number in the Chime app sections, Move Money and Settings, or by logging in to your account online.

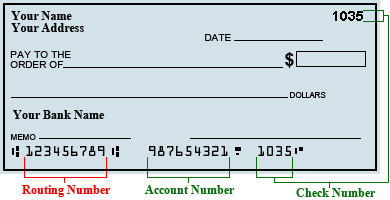

THE BANCORP BANK has 2 active routing numbers. Routing numbers consist of a nine-digit numeric code printed on the bottom of checks that is required for electronic routing of funds (such as direct deposits, domestic and international wire transfers, electronic payments, automatic payments, ACH transfers) from one bank account to another.

The easiest way to find your routing number is to look at your bank checks. It’s easy to find the bank’s ABA routing number and your account number as shown in the example check image below. The image is only for reference purposes. In some cases the order of the checking account number and check serial number is reversed.

Use the “Search” box to filter by city, state, address, routing number. Click on the routing number link in the table below to navigate to it and see all the information about it (address, telephone number, zip code, etc.)

The routing / transit number can also be identified from the translation table below. Select / Identify the routing number associated with the region where the account was initially opened.

Best credit cards of 2019 Best rewards cards Best cash back cards Best travel cards Best balance transfer cards Best 0% APR cards Best student cards Best cards for bad credit.

Credit cards 101 Pick the best credit card Boost your approval odds Balance transfers 101 Credit card debt study Range of credit scores How to build credit Debt calculator Credit Building community.

Best brokers for stocks Best brokers for beginners Best Roth IRA providers Best IRA providers Best robo-advisors Best for active trading Best for options trading. Compare online brokerages Retirement calculator Roth IRA calculator 401(k) savings calculator Calculate my net worth Capital gains tax calculator Federal tax calculator.

How to buy stocks How to choose a financial advisor Opening a brokerage account How much to save for retirement What is an IRA?

Roth IRA guide 401(k) rollover guide.

Best mortgage lenders of 2019 Best lenders for first-time buyers Best online lenders Best FHA lenders Best VA lenders Best for low down payment Best refinance lenders Best low credit lenders.

Mortgage rates Preapproval lenders Cash-out refinance rates 30-year fixed rates Refinance rates 15-year fixed rates 5/1 ARM rates FHA mortgage rates. Mortgage calculator Amortization calculator How much house can I afford? How much down payment? VA loan calculator Refinance calculator Cost of living calculator Calculators.

Estimate your home value First-time homebuyer tips Homebuying: what to expect FHA loans Get the best mortgage rate Refinancing your mortgage VA home loans. Small business loans Bad credit business loans Small business lenders How to start a business How to get a business loan Business loan calculator Merchant cash advance calculator SBA loans.

Refinance student loans Private student loans How to pay for college Complete the FAFSA Student loan repayment plans Student loan calculator Student loan refinance calculator.

Best auto loans Refinance auto loans How to buy a car Total car cost calculator Lease calculator Compare new vs used car Should I refinance?

Free car insurance comparison Best car insurance Cheapest car insurance Car insurance reviews Car insurance discounts Best cheap car insurance Compare the big 4 car insurers Car insurance estimates. Term life insurance quotes Best life insurance Life insurance reviews Life insurance calculator Rates for healthy vs. sick Term vs. whole See all.

How to build a budget Best budgeting & savings tools Budget calculator How to track expenses Short- vs. long-term goals Choosing a budget system How to fix budgeting errors How to handle debt.

How to save money Trick yourself into saving How to cut the cable cord Lower your cable bill Lower your cell phone bill Save on electric bills How to save on flights. How to make money How to find fast cash Government free money Making money via online surveys Real work-from-home jobs.

How to pay for college Career guide How much does a wedding cost? Parenting money tips Financial guide for moving Planning a vacation Travel smarter with rewards Ask the community. Banking , Banking Basics , Banks & Credit Unions , Checking Accounts , Savings Accounts. At NerdWallet, we adhere to strict standards of editorial integrity to help you make decisions with confidence. Many or all of the products featured here are from our partners. Here’s how we make money . Member, FDIC. Chime is a mobile-only bank, so it’s not like your traditional neighborhood branch. But it still has all the fundamentals and, with FDIC insurance, it’s a safe place to keep your money. It has a “spending” account, as well as a savings account. When you buy something with your bank card, you can have Chime round up the amount to the nearest dollar and deposit the difference in savings. Chime has no monthly fees or overdraft fees, but its interest rate is low. And checks and cash can be difficult to deposit.

Best if: You’re looking for free checking and savings that you can set to autopilot. More upsides:. No foreign transaction fees: This fee (at other banks, typically 1% to 3% of the amount of your purchase) can add up quickly when shopping or withdrawing money from ATMs while you’re overseas.

Get a jump on payday: You can receive your paycheck up to two days earlier than at a traditional bank if you set up direct deposit — Chime processes your employer’s check immediately instead of waiting like other banks may.

Here are some downsides:

Out-of-network ATM fee: Chime charges $2.50 per transaction.

Depositing checks, cash can be a pain: Though mobile check deposit is available, putting cash into your Chime account will require you to go to Green Dot cash deposit locations. Green Dot may charge a fee.

No checks: If you need to send a check, Chime will send one on your behalf through its Checkbook feature. There’s no limit on how many checks you can send, but you’re limited to $5,000 per payment and $10,000 in a calendar month. Your account must be open for at least 30 days to be able to use the feature. 2.5 NerdWallet rating.

Chime’s savings account is one of its top draws, although it suffers in our rating because of one major drawback. The upside: Easy ways to save.

Easy ways to save:

Chime rounds up every purchase on your Chime card to the nearest dollar and deposits that difference into your savings account. Or, have the bank automatically transfer 10% from your paycheck into your savings account. Both features are optional.

The downside: Low rate.

The savings account’s star rating is dragged down because of its low interest — an annual percentage yield of 0.01%. The upside: No overdraft fees.

Chime doesn’t allow overdrafts. If you don’t have the funds, transactions will likely be declined except in some instances, such as when you pay for gas at the pump.

The downside: No overdraft line of credit. Sometimes it helps if you can dip a little in the negative and pay the bank back with interest if it means making important payments. Chime currently does not offer this service.

The upsides: Tools put you in control. Highly rated apps: Chime’s mobile app excels where it counts — customers have rated the iOS version 4.7 stars out of 5 and given 4.4 stars, also out of 5, for the Android app.

Helps you stay on top of your money: Daily balance updates and real-time transaction alerts can help customers stay on top of their spending. And if your card goes missing, you can block transactions using the Chime app.

Second chance banking: On top of its low fees, Chime doesn’t use some screening tools that can lock people out of bank accounts who’ve had them closed in the past. That can make it a useful tool if you’re trying to restart your financial life. The downside: No branches. Chime is a mobile-only bank. Customer service, however, is available via chat in the app, by telephone or via email.

Ready to take the next step? No monthly fees, no transaction fees and no overdraft fees make banking with Chime easy. Compare it to similar banks such as Simple (see our review ) or Moven (see our review ) to find which one fits your needs best, or click below to get more information.

See banks and credit unions that are great on mobile. Ratings methodology.

NerdWallet’s overall ratings for banks and credit unions are weighted averages of several categories: checking, savings, certificates of deposit or credit union share certificates, bank experience and overdraft fees. Factors we consider, depending on the category, include rates and fees, ATM and branch access, account features and limits, user-facing technology, customer service and innovation.

Student Loans. We want to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and safe by following our posting guidelines, and avoid disclosing personal or sensitive information such as bank account or phone numbers. Any comments posted under NerdWallet’s official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise.

NMLS Consumer Access Licenses and Disclosures.

Disclaimer: NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. Pre-qualified offers are not binding. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.